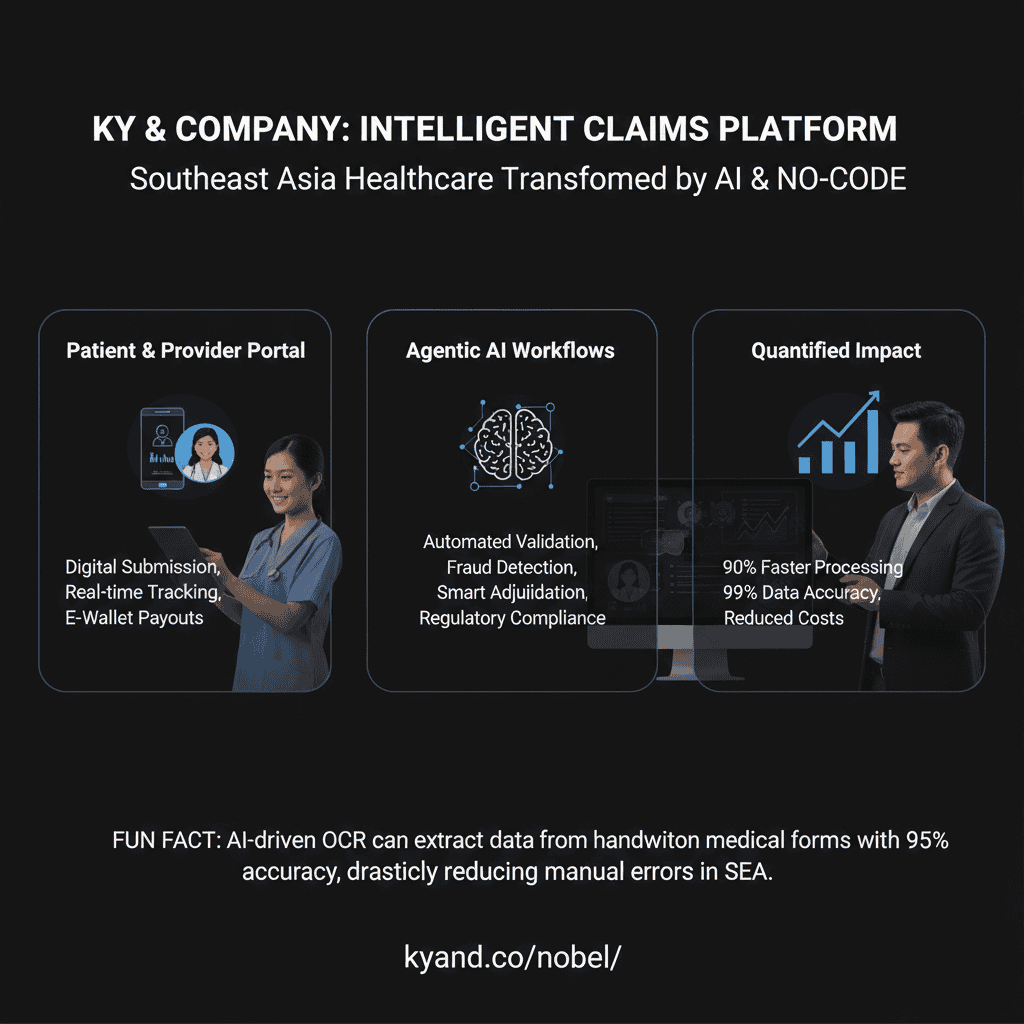

Expedited Medical Claims Processing in Southeast Asia: How No-Code Portals and Agentic Workflows Are Transforming Healthcare Insurance

Discover how no-code portals and AI-driven workflows enhance transparency and streamline healthcare insurance claims in Southeast Asia.

- Unlock Efficiency: Reduce claim processing times significantly.

- Improve Transparency: Empower patients and providers with real-time updates.

- Minimize Errors: Leverage AI for precise data handling.

- Increase Trust: Ensure secure communication and data management.

Table of Contents

- The Problem: Outdated Claim Processing in Southeast Asian Healthcare

- The Solution: No-Code Portals Meet Agentic Workflows

- Real-World Validation in SEA

- Quantified Benefits of the Integrated Solution

- Practical Takeaways for Business Leaders and IT Teams

- KY & Company: Your Partner in AI-Powered Digital Transformation

- References & Further Reading

The Problem: Outdated Claim Processing in Southeast Asian Healthcare

Despite advancements in fintech and mobile healthcare, core health insurance processes in SEA remain mired in inefficiencies. Key issues include:

- Paper-Centric Processes: Many providers still rely on fax, scanned PDFs, or email attachments for claim submissions, requiring manual review and data entry.

- Lack of Transparency: Patients and providers often cannot track the status of a claim, leading to repeated inquiries and poor customer experiences.

- High Error Rates: Manual data entry is prone to mistakes, resulting in rework, delays, and, in some cases, claim denials.

- Operational Bottlenecks: Claims teams are frequently overwhelmed with routine checks, leading to long turnaround times and higher administrative costs.

- Fraud Risks: Manual reviews make it difficult to detect fraudulent claims, which can lead to significant revenue leakage.

- Regulatory Fragmentation: Local differences in policy, billing practices, and regulations necessitate highly adaptable systems.

The Solution: No-Code Portals Meet Agentic Workflows

To solve these overlapping challenges, the proposed solution merges a customizable no-code portal with backend agentic workflows driven by AI. This integrated platform is designed for rapid deployment, localization, and automation.

1. No-Code Portal: A Configurable Digital Front End

Our no-code portal allows hospitals, clinics, and patients to interact with the insurance system efficiently and securely via web or mobile platforms.

For Providers (Clinics and Hospitals):

- Digital Claim Submission: Easily upload documents like discharge summaries and billing reports. Intelligent integrations auto-populate patient data.

- Pre-Authorization Requests: Instant submission and real-time feedback on high-cost procedures.

- Claim Status Tracking: Track every claim’s journey from submission to reimbursement.

- Secure Communication: In-app messaging with insurers to resolve queries and upload additional documentation.

- Comprehensive Analytics: Customizable dashboards to monitor rejection rates, payout timelines, and claim volumes.

For Patients:

- Self-Serve Claim Submission: Upload receipts for outpatient claims directly from smartphones.

- Real-Time Notifications: Stay informed with SMS/email updates at every claim stage.

- Policy Management: Check benefits, coverage limits, and included procedures.

- Digital Reimbursements: Receive payout through local e-wallets or bank links (e.g., GCash, OVO).

2. Agentic Workflow: AI-Powered Backend Automation

These intelligent agents streamline internal processes for insurers by mimicking and augmenting human decision-making:

Intelligent Triage Agent:

- Real-Time Validation: Verifies if forms are complete and aligns data with policy coverage.

- Document Analysis: Uses OCR and NLP to extract and validate data from uploaded documents.

- Complexity Scoring: Assigns risk levels and prioritizes based on value and medical complexity.

- Fraud Detection: Flags anomalies based on patterns like cost outliers, duplicate submissions, or invalid codes.

Automated Adjudication Agent:

- Policy Rule Matching: Instantly approves straightforward claims (e.g., routine checkup, known procedure).

- Reimbursement Calculation: Determines eligible payouts with built-in logic for co-pays and deductibles.

- Human Escalation: Routes ambiguous claims to reviewers with automated summaries and predictions.

Proactive Communication Agent:

- Status Alerts: Automatically notifies parties at every stage: submission, review, approval, payout.

- Follow-up Triggers: Requests missing documentation with clear guidance and deadlines.

Payment & Reconciliation Agent:

- Payout Automation: Integrates with digital payment systems and local bank APIs for instant or next-day transfers.

- Ledger Syncing: Updates financial systems in real-time and provides audit-ready histories for compliance.

Real-World Validation in SEA

This isn’t hypothetical. Organizations across Southeast Asia are already embracing components of this solution.

- Thailand: The iClaim platform enables hospitals to check eligibility and submit claims within 10 seconds—a dramatic reduction in processing time (source).

- Indonesia: Sembuh AI automates fraud detection and claim evaluation, reducing health claim processing time to seconds and aligning with new anti-fraud mandates from the OJK (source).

- Philippines: HyperVerge’s OCR solution reduced document errors by 90% and compliance processing time by 70% in onboarding, with similar benefits for claims anticipated (source).

- Singapore & Malaysia: Prudential uses Google’s MedLM AI suite to interpret medical documents and improve adjudication accuracy (source).

Quantified Benefits of the Integrated Solution

Implementing KY & Company’s AI-powered, no-code claims stack can lead to:

- 70–90% Reduction in Processing Time: Claims that once took days or weeks are resolved in minutes.

- 90% Decrease in Data Entry Errors: Thanks to OCR and NLP document extraction.

- Faster Cash Flows: Instant eligibility checks and digital payouts improve provider liquidity.

- Enhanced Fraud Detection: AI agents catch subtle patterns that evade manual review, cutting claims leakage.

- Localized Compliance: Tailored workflows that align with local regulations like Indonesia’s OJK fraud mandates.

- Multi-Language and Multi-Region Readiness: Easy localization for Tagalog, Bahasa Indonesia, Vietnamese, and more.

Practical Takeaways for Business Leaders and IT Teams

For Insurers:

- Modernize Without Full Core Replacement: Use no-code and agentic workflows as a digital layer on top of existing core systems.

- Regulatory Alignment: Quickly react to evolving compliance requirements in each SEA market by adjusting workflows via intuitive interfaces.

- Improve Customer Experience: Real-time status updates and mobile-first design significantly reduce customer service workload.

For Hospitals & Clinics:

- Accelerate Cash Flow: Faster approvals mean faster payments, improving operation sustainability.

- Lower Admin Overhead: Cut down on repeated status check calls, manual form submissions, and document rework.

For IT Leaders:

- No-Code = Flexibility Without Complexity: Let your business analysts own workflow configurations without burdening your development team.

- Adaptive AI Layer: Built-in agents learn and grow smarter over time, increasing ROI with every claim processed.

- Cloud-Ready & API-Native: Easily integrate with existing hospital information systems (HIS), payment hubs, and legacy P&C platforms.

KY & Company: Your Partner in AI-Powered Digital Transformation

At KY & Company, we’re not just theorizing change—we’re delivering it. Our digital consulting services and agentic workflow SaaS platforms are purpose-built to address the challenges of dynamic markets like Southeast Asia.

From designing multilingual portals for Filipino and Indonesian patients to integrating instant reimbursement into a hospital’s backend ledger, we make complex digital transformation seamless, scalable, and secure.

Looking to transform your healthcare claims process?

Let us show you how an AI-powered, no-code portal can reduce time, errors, and costs—while improving trust and transparency.

Contact Us to explore a demo or schedule a discovery session.